Guest article by Ravi Ramasamy

After spending a decade of time working in the Asia Pac reconstructive markets with three major orthopedic device leaders, I decided to write my first article during this time of need. The Asia Pac recon implant business in 2019 was estimated at $2.8 billion. Post COVID-19, this revenue may plunge to $1.5B in 2020. An immediate upsurge in joint replacement procedures post COVID-19 is unlikely as patients show reluctancy for elective procedures until a vaccination or permanent remedy is in place.

Social behaviors influence treatment decisions

COVID-19 impact on reconstructive business in APAC is likely to last longer than the rest of the world. Why is that? Most Asian cultures’ treatment decisions have always been a collective family decision (with exception to life-threatening conditions) and these decisions are often delayed in the face of unprecedented times. The fear of surgery generally has been high in Asia and the infection risk further fuels fear, leading to hesitancy towards surgery. Patients would rather bear the pain and take NSAID for an extended period of time or choose therapeutic alternatives, including Chinese medicine, to avoid exposing themselves to infection in point of care.

The unknowns

At this time, we may not know the right answers but we should at least have the right questions to find answers for predicting future trends. As of now, there is one major question that lingers in the stakeholders’ minds, “what could be the revenue impact and how long will it take to recover?”

Healthcare ecosystem impacts

In APAC, until now traditional marketing strategies and brick and mortar based Medical Education programs worked well resulting in 4-6% CAGR recon growth in the last five years.

The existing ecosystem of surgeons getting patients in continuum and companies compete for market share with differentiated value propositions, clinical advantages, and service excellence and MedEd likely will change. From 2020 onwards, the real challenge will be getting back patient inflow for elective procedures.

A low patient flow will be detrimental for APAC recon business as players will now have to bear the pain of revenue loss, cash flow crunch, and long gestation period. Although COVID-19 seems to have less impact in Asian countries in terms of disease spread or deaths when compared to Europe and the US. A severe business impact will affect all major players, Stryker will be least impacted as they have less skin in the game in the region. The only impact Stryker may have will be in Australia and Japan as the Mako momentum is likely to slow down

APAC marketing Challenges

Whatever worked well before COVID-19 may not work well from now. Companies are likely to struggle to change from the traditional marketing based strategic approach to digital marketing for rebooting business through innovative bold strategic initiatives. Orthopedic in general lacks digital marketing expertise and the current talent pool has limitations in adapting to the emerging needs for ramping up digital and social media marketing. DePuy Synthes may have an edge in digital marketing being under the JnJ umbrella. Possibilities include digital marketing initiatives with caregiver partnerships to help them regain patient flow in a shorter period.

Medical Education and Operating Room support

The brick & mortar classroom model of MedEd programs may no longer be a viable educational method. Companies will now need to identify an effective solution to fill the void by quickly moving to virtual Digital MedEd platforms.

Another challenge that could impact these companies will be the current Operating Room (O.R) support by reps. The healthcare policymakers at point-of-care will turn more reluctant towards allowing company reps or scrub techs entering O.R. This may prompt companies to shift into an online virtual real-time O.R support model. This requires new investments to meet the virtual surgical support needs for recon procedures.

Capital intense Guided Technologies less relevant now

The APAC robotic revolution will lose momentum from 2020 as hospitals and institutions across the region (both government and private sectors) will shift focus to critical and acute care related infrastructures.

COVID-19 has a huge impact on the entire caregiver’s community. Though the government health sector is likely to have less impact. From now on most hospitals will shift their focus away from arthroplasty by filling their hospital beds with other treatment options. The institutions will also invest in patient marketing and GP referrals more than ever to regain occupancy by joint replacement patients.

APAC revenue shifts and China taking the lead

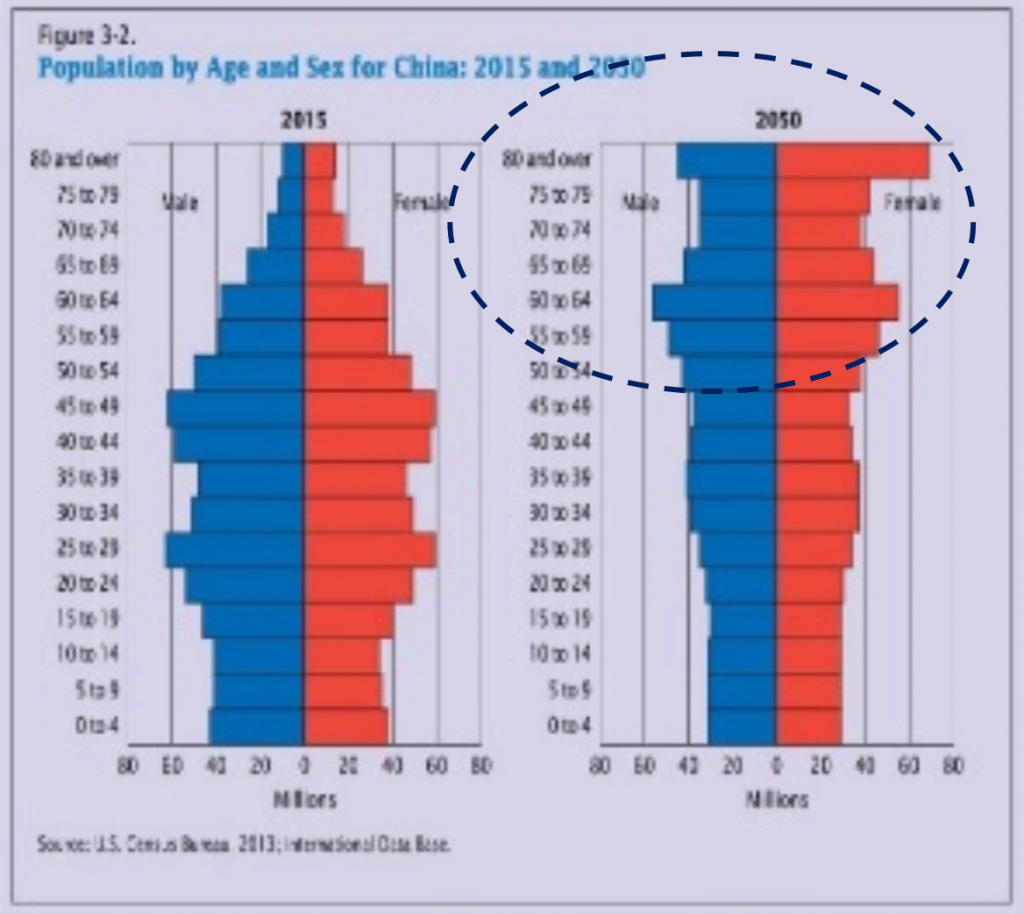

China will emerge as the biggest recon market (first by volume then by $ value) in the world in the coming years. During the early days of my career, companies would present a revenue pie chart showing “The US and Rest of the world (ROW)”. Now the time has come to state “The Republic of China and Rest of APAC” to start with! China continues to have this exponential growth in the next decade or so, mainly driven by:

1. An ever-increasing aging population with awareness and affordability

2. Availability of trained joint replacement surgeons

3. Continuous improvement of hospital infrastructures and reimbursements

From 2018, China became the second-largest partial knee volume country in the world and poised to become the number 1 partial knee market in the world by volume.

Japan leads the recon market by revenue followed by China then ANZ (Australia/New Zealand). In 2018 China became the second largest partial knee volume country in the world and is poised to become the number 1 partial knee market in the world by volume if not by value.

China reimbursement policies

China’s healthcare reimbursement policies continue to push implant cost down to meet the ever-increasing healthcare demands of the recently accelerated aging population. This is one of the biggest economic challenges that China will continue to face. Business Insider report https://www.businessinsider.com/china-demographics-problem-2016-3) states that in 2050, the size of China’s population will decline by around 60m, while the working-age population will decline by 212m or around 1/3.

Emergence of domestic players

China could see COVID-19 as an opportunity rather than a crisis being less impacted and come out of the crisis ahead of other countries in the world. Interestingly, the Chinese word “Crisis” has two symbols 危机; the first symbol means “Danger” and the next symbol means “opportunity”. This is very relevant to the current time of crisis as the domestic manufactures especially from China are capable of taking this as an opportunity to build capabilities, not only meeting the current challenges but also using this unprecedented time to adequately resource themselves for improving the design and quality standards, with aggressive volume-based pricing tactics and increase point of care relationships.

This will ultimately push global players to the top of the pyramid segments in China and very soon across the Asia Pac region, leaving the bottom of the pyramid to emerging domestic players mostly from China followed by few other APAC players from Taiwan (United), Australia (Allegra/Signature) and Japan (Kyocera). Few global players do have some China-specific brands but inadequate by all means and also lack long term vision.

It will be interesting to see how the APAC reconstructive market takes shape in the coming years and how the companies continue to win in the APAC region by managing cash flow crunch, adapt and strategize.

Ravi Ramasamy a marketing professional with specialized experience in reconstructive orthopedics (arthroplasty). He has a unique insights into the Asia Pac recon market. Ravi’s career has spanned sales, upstream and downstream marketing roles in the US and Asia Pac regions at J&J, DePuy-Synthes, S+N and ZB.

You can contact Ravi at [email protected] or on Linkedin here.