SUMMARY

This article discusses the realities of startup investments and highlights the fact that entrepreneurship does not necessarily lead to riches. The article advises entrepreneurs to focus on building a company with the intention of creating a better world, rather than solely to make money. Examples are provided with data from various sources to illustrate the likelihood of success in the startup industry and highlights the importance of having an honest assessment of the company’s total addressable market and its ability to influence market share. The conclusion is that founders should pay more attention to exits valued at less than $1 billion, as these are where the majority of exits occur.

Originally published on frontruncrypto.com — click here to subscribe for free.

Dear frontrunners,

What’s more admirable than throwing caution to the wind in the pursuit of the entrepreneurial dream? How many of us envision a future where we are our own boss and the master of our destiny?

The grit and determination to start your own company and “be your own CEO” should stem from an innate desire to make the world a better place with the creation of your product or service. In the absence of this passion, most people view the nobility of entrepreneurship as a byproduct of wanting to be rich.

I am here to tell you, start-ups will not make you rich. This is especially true for “founding team members” (pre-seed) and “early employees” (seed round, series A).

This statement is true for entrepreneurs pursuing new products in web2 as well as the emerging web3 ecosystem.

Over the past week, I’ve been advising an early-stage founder as he embarks on his first seed round. Yes, he was excited, it’s an amazing testament to his grit and determination to raise a seed round in the midst of this economic uncertainty.

His excitement, unfortunately, was paired with discontent and confusion as he reviewed the term sheet proposed by his VC:

- He is getting diluted — alot

- His founding team members are getting diluted — alot

- His VC wants preferred shares

- The pre-money valuation is based on a post-money option pool

There’s so much to unpack in the aforementioned 4 points, in this guide we’re going to review each item individually. As we explore the VC’s offer, keep this data in mind:

- 90% of start-ups fail

- 75% of all venture-backed companies fail

- Only 1% of start-ups reach a >$1 billion dollar valuation

This is not a knock on the entrepreneurial pursuit. Self-agency, mastery of your destiny, and the acceptance that you are your own savior are characteristics we should all embrace. If you have an amazing idea that is going to revolutionize the world then go burn the midnight oil and get it done (and message me!).

This is a warning that if your goal in creating a start-up or joining an early-stage company is to make money, then you should pass.

Founders get diluted — alot

Most entrepreneurs and start-up enthusiasts generally agree that dilution will occur as your company raises more money, but it’s “OK” because in the aggregate, the fully-diluted value (the value of all outstanding stock + the value of all stock that could be issued) increases with each round. Your percentage ownership in your company decreases but the value of the shares you own increases.

This looks enticing, right? Sure by series G you only own 17% of the firm, but now it’s valued at $1,000,000,000 (billion).

“16% of one billion is worth more than 80% of zero” -A typical VC says as the founder signs his life away

Technically the VC is correct. In this example:

- If this founder sold his company for $1 billion with a $7,000,000 post-money valuation from the previous round he would generate ~$571,000,000 of new wealth.

A $1,000,000,000 exit would produce $160,000,000 of new wealth. Still amazing.

The problem with this scenario is that it is the rosiest of rosiest outcomes. Seriously, name one company that closed a round $7 million round and was subsequently acquired for $1 billion dollars. It doesn’t happen, and start-ups eventually need to raise a second round. There is one problem:

- Only 48% of start-ups who raised a seed round were able to raise a 2nd round

- Only 15% of start-ups raised went on to raise past a 3rd round

In the CBInsights venture capital funnel review of 1,119 companies, only 13 exited for over $500,000,0000, and just five exited for over $1,000,000,000: Uber, Airbnb, Stripe, Slack, and Docker.

Founders need to have an honest assessment of their total addressable market and ability to influence market share. My guidance to founders is to focus on exit values at less than $100,000,000 because that is where the majority of exits occur.

The Founder’s Collective published a 2-year review of its exits and outlined the median exit value to be $44,000,000. When looking at exits under $100,000,000 — the average exit was $28,000,000. Almost 60% of the companies that exited their portfolio in 2020 did so for a sum lower than the average pre-money valuation for a Series A in 2020.

Their conclusion?

VCs focus on $1B+ exits. Founders should pay more attention to <$1B exits. Founders don’t have a portfolio of startups to spread financial risk. There’s no hedging at a startup. — Founders Collective

A more robust analysis of 10,136 exits from Pitchbook outlined that ~70% of all start-up exits were completed for under $100,000,000. Only .35% or 0.035 achieved unicorn status.

The inclusion of pre-COVID M&A data is intentional as it is my opinion the growth we experienced from 2021 through 2022 was a byproduct of loose monetary policy. The wealth creation experienced over the past 24 months in public and private markets has been decimated by an about-face of our central bankers in their quest for a legacy. You can read more about it in these two guides — 40 years of failed US monetary policy and Welcome back to work Diamond Hands.

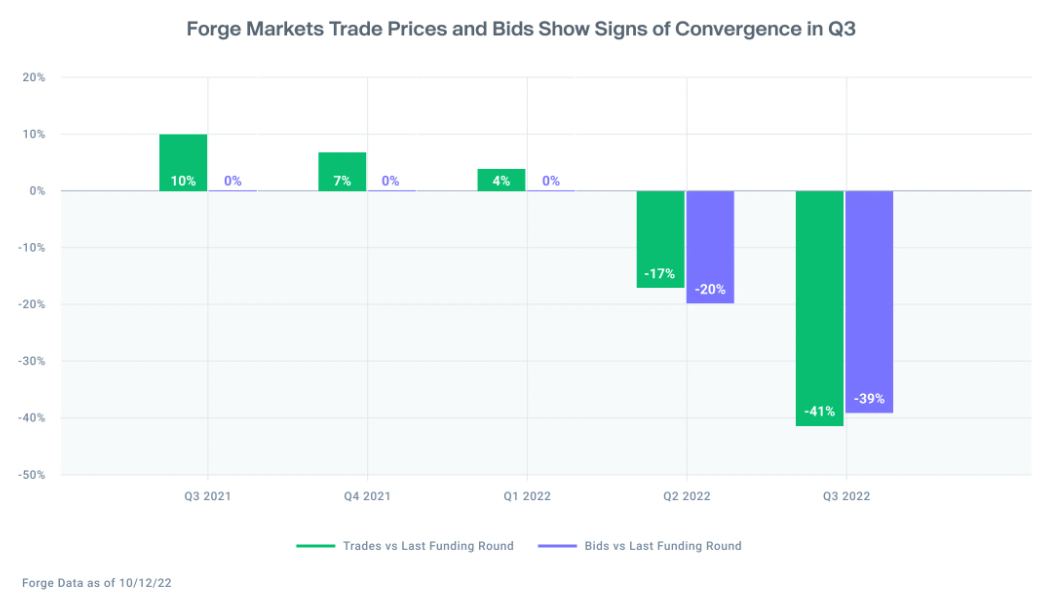

The 2022 contraction of valuation for pre-IPO startups is undeniable: ForgeGlobal, a secondary market for pre-IPO startups, disclosed that companies on its platform are trading at a 41% discount relative to its last funding round.

Their conclusion? The worst is yet to come.

Private Market Lags Public Market by Approximately One Quarter. On average, prices fell 22.2% when comparing the price of companies that traded on Forge Markets in both Q2 2022 and Q3 2022. Meanwhile, public tech indices slowed their pace of losses in Q3, with the NASDAQ falling -4.3%, the IPO ETF falling -5.67%, and the widely watched ARKK ETF falling -5.39%. — Forge Global October 2022 Private Market Update

My theory is that as economic uncertainty persists investors will continue to flee to safety. The cost of capital will continue to increase as the central banks double down on funding rate increases on their quest to 2% percent inflation.

Practically speaking, this means the risk-free rate of return will go up (10-year US government notes currently yield 4.02%) as the public and private valuations go down on the backdrop of macroeconomic conditions related to inflation, supply chain issues, flat wages, and global uncertainty with respect to Russia and Taiwan.

What does this mean for our founder?

Don’t expect a unicorn. During an era of loose monetary supply (money printer go brrr) less than 1% of all VC-backed companies had a $1,000,000,000 exit. In 2023 and beyond, it’s time to manage expectations and focus on best-case sub $100,000,000 exits.

If we assume a best-case $50,000,000 exit based on the aforementioned data and reduce subsequent funding rounds based on post-COVID valuations, a typical founder who is able to achieve an exit will walk away with ~$11,000,000.

$11,000,000 sound great right? Pause a moment and consider the funnel from seed to acquisition post series C is < 15%. Moreover, the average time to exit is 11 years.

There is an opportunity cost founders and early employees need to consider relative to earnings potential. What would your earnings potential be if you went to work in finance, consulting, or big tech? Is the risk of the potential lost income worth it? Can you afford it?

With this founder, we’re framing the opportunity cost against compensation at a “big tech” or strategy/management consultancy firm. I think these numbers are a little low but serve as a general reminder; founders are giving up a stable income stream for substantial uncertainty. This uncertainty is more apparent for experienced hires who quit to start their own company vs new college graduates.

Consider someone working in big-tech/finance/consulting for 10+ years. These are “experienced hires” and command a compensation plan between $300,000 and $400,000 if not more. Over an 11-year window, they’ll earn between $3,500,000 and $4,500,000.

If they leave their golden handcuffs to pursue a start-up as a founder; two challenges will arise:

- In the beginning, they will earn $0 and must draw from savings

- As the start-up grows, their VCs will eventually grant them a salary that will be less than what they make at big-tech

If the founder has an $11,000,000 exit then yes, the journey was worth it. They will net ~$8,000,000 more compared to their big tech equivalent. The risk? If the start-up fails to exit, the founder will realize ~$2,500,000 in missed compensation.

The opportunity cost founders should explore as part of their journey to wealth creation is the risk-reward profile relative to working at Google, McKinsey, or the best-case highest-paying firm that will hire you.

Answer the question below:

Would you rather make $4 million in 11 years or have a 15% chance of making $12 million and an 85% chance of making $1.3 million?

Only the founder can answer that. But if you think it’s bad for the founder, it’s abysmal for the founding team and early employees.

Founding team members and early employees get diluted — alot

Seed companies are usually floated by one or two founders who commit to the mission full-time, while “hiring” a team of early adopters who moonlight for the startup while working at their day job full-time. These ‘moonlighters’ are usually rewarded with between 5% and 10% of founding team shares. In this scenario;

- The founder had 80% of the founding shares — he quit his job, self-funded, and committed to bringing the vision to life

- 4 other team members were each given 5% each — they had day jobs and committed to the project up to 10 hours per week

These poor souls who worked for free to eventually join as a “founding team member” will get rekted, every single time.

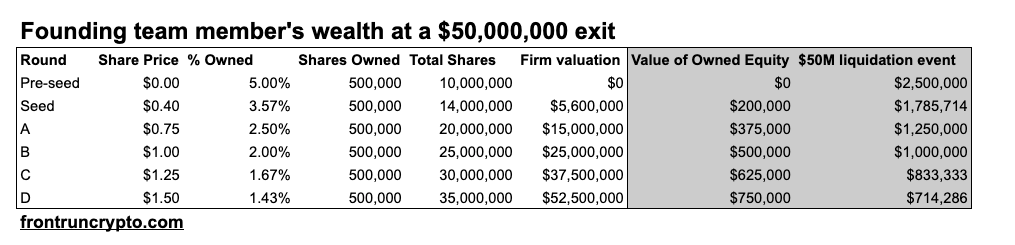

A founding team member with a five percent ownership in common shares will realize ~ $714,000 of wealth creation at a $50,000,000 exit. Which again, takes 11 years. When we frame the founding team member’s opportunity cost against a big-tech/consultancy/finance job, the theme is undeniable — founding team members lose money.

- A new-hire college graduate will earn $2,100,000

- An experienced hire will earn $3,850,000

- With a successful exit, a founding team member will earn ~$2,000,000

- Without an exit, they’ll learn ~$1,350,000

Moreover, early employees who are not founding team members (think series A, first sales hire, first product manager hire, etc) are doomed. Even if we assume a best-case $1 billion unicorn exit, early team members will not experience the same wealth creation opportunity as their founding member counterparts.

This is also disappointing because these individuals are also asked to commit to the mission and burn the midnight oil. But why should they? How is this fair?

Anyone who wants to work for a start-up must perform their own due diligence and answer the following questions:

- Will there be additional funding rounds at my company? How many? How much dilution will I experience?

- How confident am I that this startup will have an exit? At $50 million, at $500 million, at $1 billion?

- How much of a pay cut am I willing to take to work at this start-up?

- If the company does exit, will I recoup my missed opportunity cost? By how much? What is my upside?

VCs and preferred shares.

An unfortunate reality for founders is that VCs create a 2-tier class system of ownership. It is called “preferred shares”.

Founders and employees are given ownership of the company via common shares while VCs who provide funding retain ownership via preferred shares. Preferred shares confer “advantages” to investors which help them manage their risk, this is usually in the form of provision and liquidation preferences.

In plain English, it means that VCs want their money back, plus a return, before everyone else, including founders and early employees. The provisions which define this structure are usually as follows:

Liquidation preferences: where preferred investors can realize a return of multiple times of their investment (i.e. 1.5x or 2.0x) upon liquidation (rather than the traditional 1.0x) prior to common stock receiving any consideration

Senior liquidation preferences: where new preferred investors receive a return of their capital prior to earlier preferred investors

Participating preferred, where preferred investors can realize both a return of their capital while also participating in the upside after their capital is returned as part of the preference;

Full or partial ratchet, where preferred investors will reset the price of their shares (by receiving more shares) if any subsequent financing round is completed at any price below their investment valuation

Redemption provision, where preferred investors have the right to force the company to buyback their investment on demand.

Consider a seed round investor with 2x liquidation preference who invested $2 million at a $6 million pre-money valuation ($8 million post-money valuation). They would own 25% of the company ($2 million / $8 million).

- If the company sold for $50,000,000 the investor would first get back 2x of their investment — $4 million

- The remaining $46 million would be distributed amongst all shareholders

- The founder would now receive $10.5 million, not the $11.5 million referenced in the previous table

The cost to the founder of just the 2x liquidation preference? One million dollars.

What can we conclude?

Start-ups are inherently risky and all exits should be framed against the probability of the event actually occurring as well as the opportunity cost of the start-up vs a plan-b career. Most start-ups will fail, this is undeniable. Less than one percent exit for a billion-dollar multiple. Some, unfortunately, spend all eternity as zombie companies, a dire outcome where your equity is locked in limbo forever. RIP.

If start-ups are able to persist to an exit, it will probably be between $20 million and $50 million. For the founders, this may net between $10 million and $12 million, for founding team members and early employees, the most likely outcome is a wealth creation event between $200,000 and $1 million. Although this sounds like a reasonable amount, it should be framed against an 11-year horizon — the average time it takes for a start-up to exit.

When early founding team members and early employees compare their 11-year earnings potential against their “big tech” alternative, reality quickly sets in — working at a start-up will not make them rich.

In part 2 of this analysis, we’ll cover a very special provision that further dilutes founders and early employees: option pool dilution aka “the option pool shuffle”. Access it below.