In our dynamic world of orthopedics, external market financial trends can wield considerable influence on companies. These trends often operate independently of a company’s efforts to innovate and provide exceptional services to healthcare providers. In this article, I delve into three compelling macro trends that are currently shaping the orthopedics landscape, sharing insights that I believe will greatly benefit our community.

Trend #1 – Extremities is growing faster than Joints which is growing faster than Spine.

A remarkable trend is unfolding in the orthopedic industry as different segments experience varying rates of growth. Notably, the extremities companies are growing faster than the joint companies, which in turn is growing faster than the spine companies.

This intricate dance of growth in different segments is reflected in the financial performance of the public companies.

Examples below from fresh Q2 earnings:

EXTREMITIES

Treace posted a 45% revenue growth Y/Y in Q2.

Paragon 28 posted a 20% revenue growth Y/Y in Q2.

JOINTS

Stryker posted a 11% revenue growth Y/Y in Q2 (but only 1% in their Spine business)

ZB posted a 5% revenue growth Y/Y in Q2.

SPINE

Globus posted a 11% revenue growth Y/Y in Q2.

Nuvasive posted a 2% revenue growth Y/Y in Q2.

ZimVie posted a -4% revenue loss Y/Y in Q2.

SI-Bone posted a -4% revenue loss Y/Y in Q2.

ATEC posted a 39% revenue growth Y/Y in Q2. ATEC is the anomaly because they are growing the top line revenue at any cost. For instance, their earnings loss was 38% worse. Said another way, it costs ATEC $166M to create $116M in sales last quarter.

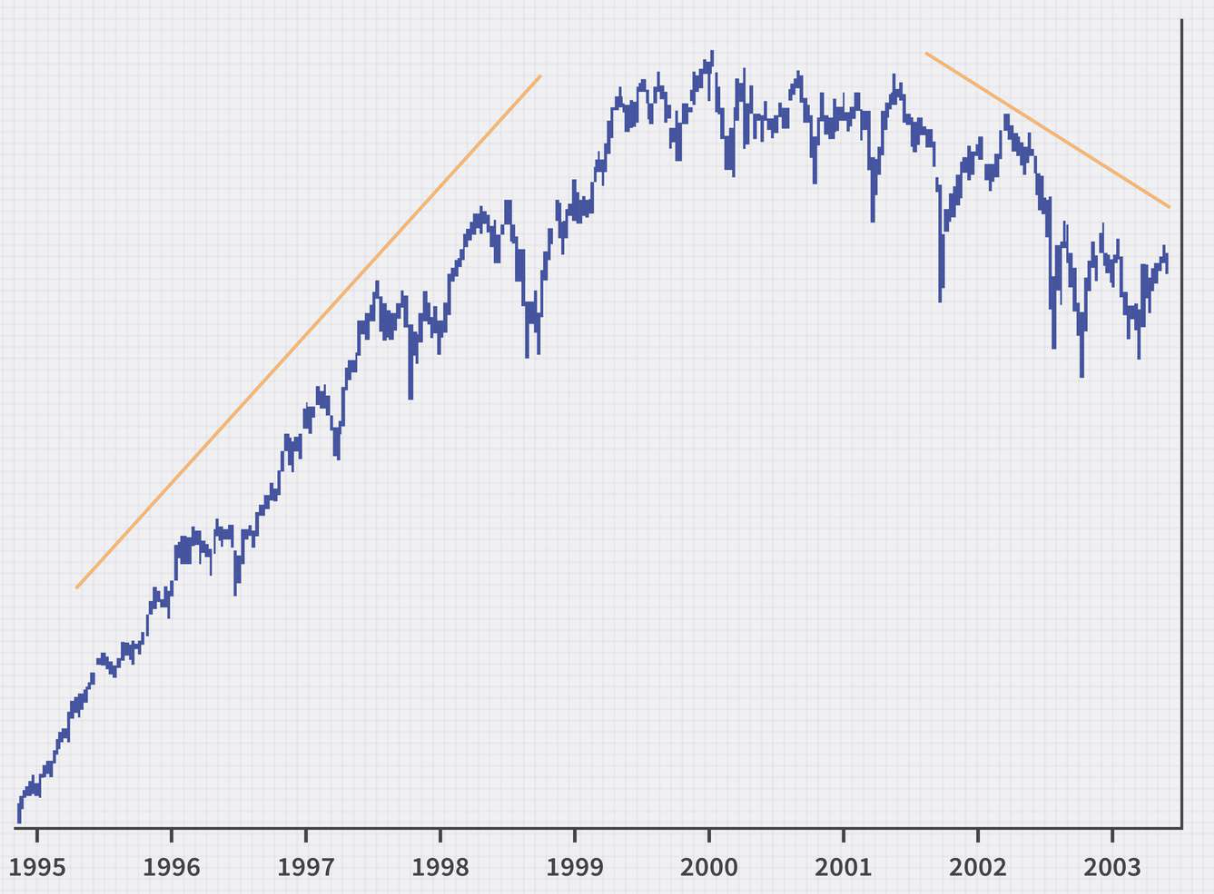

Trend #2 – The IPO market will be opening soon. In late 2024 we will see two distinct reasons for IPOs.

1/ IPOs for strong companies that have been waiting to tap into the public markets. Investors in these strong companies have been patiently waiting for access to the IPO market.

2/ IPOs for weak companies that will be forced to go public at low market values, because the venture market has dried up and debt is too expensive. They will be forced to IPO next year.

Stay tuned for a rash of IPOs in 2024.

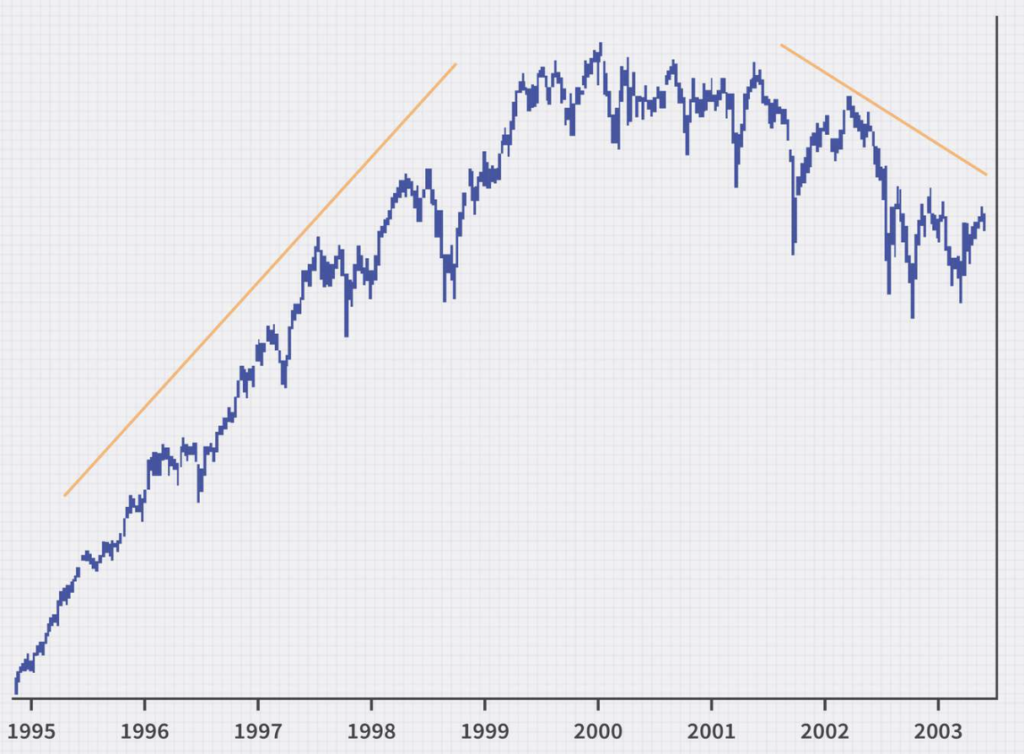

Trend #3 – Debt will become a BIG DRAG on the ortho companies in this new world of high rates, lack of liquidity, and lower stock prices.

Amidst an era of elevated interest rates, liquidity constraints, and diminished stock prices, the weight of debt is emerging as a formidable challenge for orthopedic companies. As orthos grapple with substantial debt obligations, the ramifications ripple through the industry, influencing consolidation, partnerships, and operational decisions.

Examples:

Nuvasive carries $1.36B in debt with annual gross sales of $1.2B. Ouch! This will have to be serviced by Globus after closing.

Alphatec carries $632M in debt with annual gross sales of $350M. Ouch!

Conformis carried $34M in debt with annual gross sales of $62M. This is one of the factors that took Conformis down.

Surgalign carried $96M in debt with annual gross sales of $81M. This is one of the factors that took Surgalign into Chapter 11 bankruptcy.

We will see more ortho companies struggling because of huge debt burden.

Below is an explanation of 10 negative affects on a company when the cost of debt is increasing.

1. Increased Interest Expenses: Higher cost of debt translates into higher interest payments that the company has to make on its outstanding debt. This can directly affect the company’s profitability and cash flow, as a larger portion of its earnings will be used to service the debt.

2. Reduced Profit Margins: As interest expenses increase, the company’s operating profit margins can shrink, leading to decreased profitability. This can result in lower earnings per share (EPS) and reduced returns for shareholders.

3. Cash Flow Constraints: Higher debt costs can put pressure on the company’s cash flow, potentially limiting its ability to invest in growth opportunities, research and development, and other strategic initiatives.

4. Credit Ratings and Borrowing Capacity: If the cost of debt increases significantly, credit rating agencies may take notice and potentially downgrade the company’s credit rating. This can make it more expensive for the company to borrow in the future and could limit its access to capital markets.

5. Investor Confidence: Investors may view a company with increasing debt costs as riskier, which can lead to a decline in stock price. Shareholders and potential investors may worry about the company’s ability to meet its financial obligations.

6. Dividend Pressures: If the company has been paying dividends, rising debt costs might force the company to reconsider its dividend policy. The company might choose to allocate funds toward debt repayment instead of distributing dividends.

7. Capital Allocation Decisions: With higher debt costs, the company might need to reassess its capital allocation decisions. It might prioritize debt reduction over expansion, mergers, or acquisitions.

8. Regulatory Compliance: Higher debt costs can affect the company’s ability to meet financial covenants specified in its debt agreements. Breaching these covenants could trigger penalties or even acceleration of debt repayment.

9. Refinancing Challenges: If the company has upcoming debt maturities, higher debt costs could make it more challenging to refinance the debt at favorable terms, leading to refinancing difficulties or higher refinancing costs.

10. Competitive Disadvantage: A company with increasing debt costs might become less competitive compared to peers that have lower debt burdens and costs. This could affect the company’s ability to price its products competitively.

11. Perceived Risk: Analysts and investors often assess a company’s financial health based on its debt-to-equity ratio and interest coverage ratio. Higher debt costs can increase perceived financial risk and negatively impact the company’s valuation.

Tiger Buford – retained recruiter dissecting orthopedics

Tiger Buford – retained recruiter dissecting orthopedics